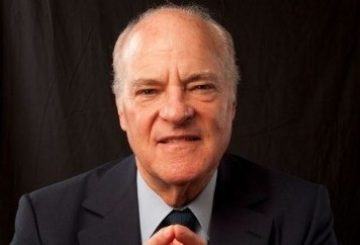

Henry R. Kravis (born January 6, 1944) is an American businessman.[1] He is the co-founder of Kohlberg Kravis Roberts Co., a private equity firm with $94.3 billion in assets as of December 31, 2013. He has an estimated net worth of $4.8 billion as of September 2015, ranked by Forbes as the 108th richest man in America and the 278th richest man in the world.[1] He mainly lives in New York City and has a residence in Palm Beach, Florida.

Kravis was born into a Jewish[2] family in Tulsa, Oklahoma, the son of Bessie (née Roberts) and Raymond Kravis, a successful Tulsa oil engineer who had been a business partner of Joseph P. Kennedy. Kravis began his education at Eaglebrook School, ('60) followed by high school at the Loomis Chaffee School. He attended Claremont McKenna College (then known as Claremont Men's College) and majored in economics. He was a member of the CMC varsity golf teams for four years and was a member of the Knickerbockers student service organization. He served as his sophomore class Secretary/Treasurer. He graduated from CMC in 1967 before going on to Columbia Business School, where he received an MBA degree in 1969.[3]

KKR Co. L.P. (formerly known as Kohlberg Kravis Roberts Co.) is an American multinational private equity firm, specializing in leveraged buyouts, headquartered in New York. The firm sponsors and manages private equity investment funds. A pioneer in the leveraged buyout industry, the firm has completed over $400 billion of private equity transactions since its inception.[2][3]

The firm was founded in 1976 by Jerome Kohlberg, Jr., and cousins Henry Kravis and George R. Roberts, all of whom had previously worked together at Bear Stearns, where they completed some of the earliest leveraged buyout transactions. Since its founding, KKR has completed a number of landmark transactions including the 1989 leveraged buyout of RJR Nabisco, which was the largest buyout in history to that point, as well as the 2007 buyout of TXU, which is currently the largest buyout completed to date.[4][5] KKR has completed investments in over 160 companies since 1977, completing at least one investment in every year except in 1982 and in 1990.[6]

KKR is headquartered in New York City with 13 additional offices in the United States, Europe and Asia.[1] In October 2009, KKR listed shares in the company through KKR Co., an affiliate that holds 30% of the firm's ownership equity, with the remainder held by the firm's partners. In March 2010, KKR filed to list its shares on the New York Stock Exchange (NYSE),[7] with trading commencing four months later, on July 15, 2010.